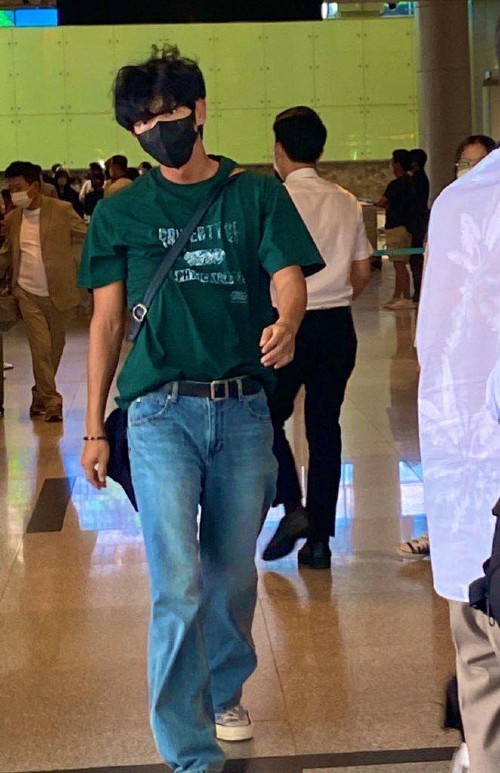

Lee Joon-gi Under Tax Investigation, Pays 900 Million KRW in Back Taxes

Lee Joon-gi’s Response to Tax Issue

On the afternoon of March 19th, Lee Joon-gi‘s agency, Namoo Actors, stated, “Actor Lee Joon-gi underwent a regular tax audit by the Gangnam Tax Office in 2023 and paid the full amount of the taxes assessed in respect of the decision of the tax authorities.”

They continued, “This taxation was a matter arising from differences of opinion regarding the interpretation and application of tax laws between tax agents and tax authorities, and was a completely different decision from previous taxation practices. There are conflicting opinions regarding the appropriateness of this decision not only among tax experts but also in academia.”

The agency explained, “At the time of the investigation, the issues with the tax authorities were whether the tax invoice transactions between our company and JG Entertainment, which was founded by actor Lee Joon-gi, were legitimate, and whether the tax on this income should be viewed as JG Entertainment’s corporate tax or Lee Joon-gi’s individual income tax. During this investigation, other than the differences in perspectives on the application of corporate tax and income tax, no other tax evasion or tax avoidance related to actor Lee Joon-gi was pointed out.”

According to the agency, issues mentioned in this tax assessment was never brought up during past regular tax investigations and there are no previous judgments from the tax authorities or courts regarding the practice of managing income and assets through a private corporation. As a result, they have filed a request for an examination to hear the decision of the Tax Tribunal once again, and the examination is currently in progress.

Finally, they insisted, “Actor Lee Joon-gi has tried to faithfully fulfill his tax obligations under the advice of his tax agent. As a Korean company and a citizen, Namoo Actors and actor Lee Joon-gi will thoroughly comply with the law and procedures and fulfill our responsibilities and obligations.”

Previous Tax Allegations

Meanwhile, actor Lee Joon-gi is currently under scrutiny after being investigated by the National Tax Service of South Korea. According to a report from TVReport on March 19, the renowned star was required to pay 900 million KRW (approximately 620,000 USD) in back taxes following a thorough examination of his financial records.

The investigation, which reportedly began nearly two years ago, primarily focused on JG Entertainment, the company Lee Joon-gi established in 2014. Despite having an exclusive contract with Namoo Actors, the actor’s earnings from his projects were funneled through JG Entertainment, which classified them as corporate income. This classification allowed the company to pay a 24% corporate tax instead of the significantly higher 45% personal income tax. Authorities suspect that this financial arrangement was deliberately structured to reduce tax liabilities, prompting an extensive review of his financial transactions.

Adding to the controversy, reports emerged concerning a high-end penthouse in Cheongna, Incheon, which JG Entertainment acquired in 2021 for 2.95 billion KRW (approximately 2.1 million USD). Speculation arose that Lee Joon-gi had been using the property as his personal residence, fueling further scrutiny.

However, his representatives categorically denied these claims, clarifying that the penthouse serves as JG Entertainment’s official headquarters. The tax authorities have since reviewed the matter and found no legal violations concerning the property.

Despite the ongoing tax dispute, Lee Joon-gi’s agency maintains that the actor has been fully cooperative with authorities and is committed to resolving the issue transparently.